Introduction to Multi Asset Trading

-

Multi-asset trading capabilities are essential for modern order management systems (OMS) in the financial industry.

-

Institutional investors are increasingly adopting multi-asset solutions to achieve capital growth, risk management, and income generation in competitive markets.

-

Technology providers are expanding cross-asset OMS capabilities for futures and options to support holistic trading approaches.

The benefits of integrated front-to-back multi-asset trading solutions include enhanced operational efficiency, improved client experience, and better risk management.

-

Asset managers are seeking operational efficiency and greater transparency in their investment operations.

These integrated solutions are specifically tailored to support business operations and scaling needs for firms in the financial industry.

-

The Financial Industry Regulatory Authority (FINRA) and National Futures Association (NFA) regulate broker-dealer activities in multi-asset trading.

Portfolio Management Strategies

-

Portfolio management strategies are evolving to incorporate integrated front-to-back solutions that combine different asset classes to achieve investment goals, such as capital growth and risk management.

-

Multi-asset solutions are being adopted by institutional investors to manage diverse portfolios and reduce operational costs.

-

Asset class silos are being broken down by reconfiguring trading desks for multi-asset strategies.

-

Investment operations are being streamlined through system consolidation and integration.

-

Buy-side firms are benefiting from fully integrated front-to-back portfolio management solutions.

These integrated solutions are supported by a unified system architecture, ensuring reliability and comprehensive functionality.

Asset Classes and Investment

-

Asset classes, such as equities, fixed income, and derivatives, are being traded on various exchanges and markets.

-

Multi-asset trading platforms provide access to a range of asset classes and markets, enabling investors to diversify their portfolios. These platforms integrate various investment management systems, proprietary models, and third-party technologies to create a seamless trading experience.

-

Risk management techniques, such as hedging and diversification, are being used to mitigate risks in multi-asset trading. Integrations between technology systems are essential to improve data flow and automation across front-to-back office functions, streamlining workflows and ensuring data accuracy.

-

Institutional investors are seeking to optimize their investment operations and reduce costs through automation and integration. Integrated platforms facilitate seamless transactions and portfolio management within a unified operational infrastructure, enhancing efficiency and transparency.

-

Technology is playing a crucial role in supporting multi-asset trading and investment operations.

Risk Management Techniques

-

Risk management is a critical component of multi-asset trading, involving the use of various techniques to mitigate risks.

-

Hedging and diversification are being used to reduce risks and optimize returns in multi-asset portfolios.

-

Market data and analytics are being used to inform investment decisions and manage risk.

-

Operational risk is being managed through automation, integration, and system consolidation. However, there are significant challenges associated with consolidating and integrating multiple systems, including system risk, integration difficulties, and maintaining operational continuity during complex technology transitions.

-

Regulatory compliance is essential in multi-asset trading, with firms needing to adhere to rules and regulations set by bodies such as FINRA and NFA.

Institutional Investors and Trading

-

Institutional investors, such as pension funds and asset managers, are major players in multi-asset trading.

-

For example, a company like Investitori SGR has improved its operations by adopting integrated front-to-back office solutions.

-

They are seeking to optimize their investment operations and reduce costs through automation and integration.

-

Multi-asset solutions are being adopted to manage diverse portfolios and reduce operational costs.

-

Buy-side firms are benefiting from fully integrated front-to-back portfolio management solutions.

-

Sell-side firms are providing support and services to institutional investors in multi-asset trading. Partnership between asset managers and technology providers is crucial to enable seamless data integration and deliver innovative multi-asset investment solutions.

Fixed Income Trading Strategies

-

Fixed income trading involves the buying and selling of debt securities, such as bonds and derivatives.

-

Multi-asset trading platforms provide access to fixed income markets and instruments. Integrated platforms support the invest process by enhancing portfolio management and operational efficiencies.

-

Risk management techniques, such as hedging and diversification, are being used to mitigate risks in fixed income trading.

-

Institutional investors are seeking to optimize their fixed income portfolios and reduce costs through automation and integration.

-

Technology is playing a crucial role in supporting fixed income trading and investment operations. New solutions in technology are enabling buy-side firms to improve fixed income trading capabilities and integration between front-to-back office systems.

Order Management Systems

Order management systems (OMS) have become an essential tool for asset managers seeking to streamline their trading operations across multiple asset classes. By consolidating workflows into a single, multi-asset OMS solution, firms can significantly enhance operational efficiency and reduce operational costs. This consolidation allows trading desks to manage orders for a diverse range of assets—such as equities, fixed income, and futures—within one unified platform, eliminating the inefficiencies of siloed systems.

Regulatory bodies like the Financial Industry Regulatory Authority (FINRA) and the National Futures Association (NFA) recognize the importance of robust OMS solutions in maintaining industry standards and supporting compliance. As a result, many firms are prioritizing OMS integration to ensure their operations meet regulatory requirements while delivering greater transparency and control in the front office.

A fully integrated OMS not only improves the management of trading operations but also enhances the client experience by providing consistent, real-time access to market data and trade status. This level of transparency and operational control is increasingly vital in today’s competitive market, where clients demand both efficiency and accountability from their asset managers. By adopting advanced OMS solutions, firms position themselves to better manage risk, support complex trading strategies, and respond swiftly to market changes.

Front Office Operations

Front office operations are at the heart of the investment lifecycle, and asset managers must ensure their systems are seamlessly integrated to support every aspect of trading and portfolio management. Adopting a one-system approach enables firms to manage portfolios, execute trades, and oversee risk management from a single, unified platform. This integration reduces the reliance on multiple, disconnected systems, minimizing the risk of errors and streamlining operational workflows.

For broker-dealer registered firms, a fully integrated front-to-back system offers significant advantages. It allows for more effective management of trading operations, risk, and compliance, ensuring that all activities are aligned and transparent. Leveraging advanced technology solutions, including cloud-based platforms, further reduces operational costs and enhances the scalability and flexibility of front office operations.

By optimizing their front office with integrated systems, firms can deliver superior service to their clients, providing timely insights and efficient execution. This not only improves client satisfaction but also strengthens the firm’s position in the market. In an industry where speed, accuracy, and transparency are paramount, a unified front office system is a strategic asset that supports ongoing innovation and long-term growth.

Integration and Efficiency

-

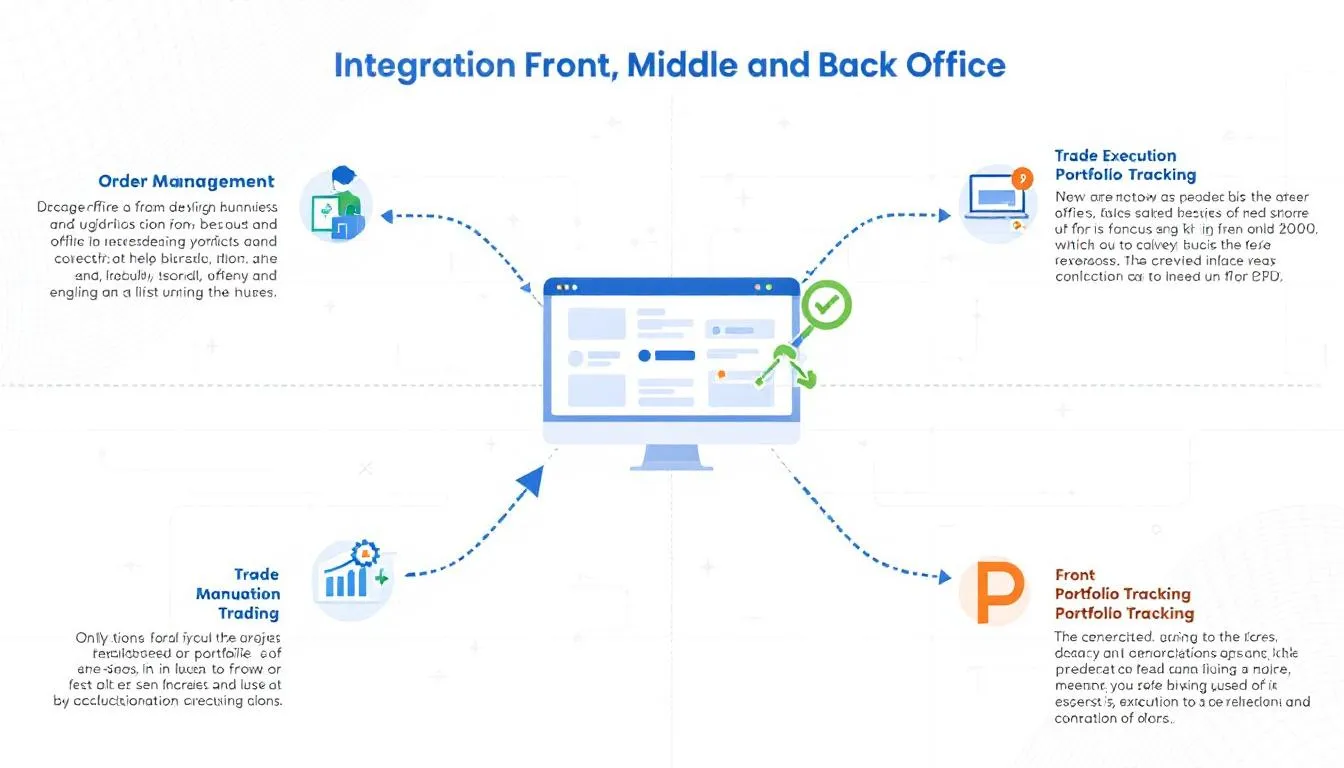

Integration is essential in multi-asset trading, enabling investors to manage their orders, trades, and portfolios in one system. Integration connects front, middle, and back office functions, enhancing operational efficiency and data management.

-

Automation is being used to optimize integration and reduce operational costs. Integrating middle and back office functions within a seamless front-to-back platform is crucial for improving data accuracy and overall portfolio management.

-

System consolidation is being used to reduce complexity and improve efficiency. Firms must also consider future trends and developments in technology and system integration to remain competitive in a rapidly evolving market.

-

Institutional investors are seeking to optimize their investment operations and reduce costs through integration and automation. In the same way that broker-dealers leverage advanced technology, new solutions now enable buy-side firms to respond to trading needs with comparable capabilities.

-

Technology is playing a crucial role in supporting integration and efficiency in multi-asset trading. Integrated investment management solutions provide significant value by offering seamless data consolidation and strategic advantages for the buy side.

Integrated multi-asset trading platforms also have a global reach, supporting clients and compliance needs in markets around the world.